All Categories

Featured

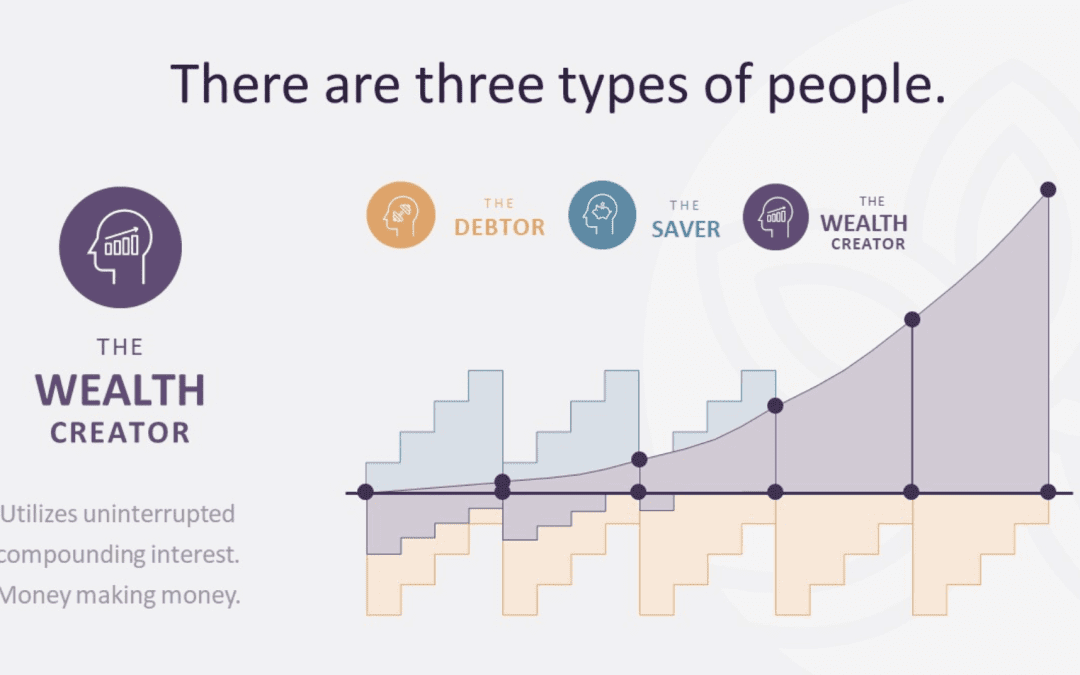

It appears like the name of this principle adjustments once a month. You may have heard it referred to as a perpetual wide range technique, household banking, or circle of wealth. Whatever name it's called, unlimited financial is pitched as a secret means to construct wealth that only rich individuals know about.

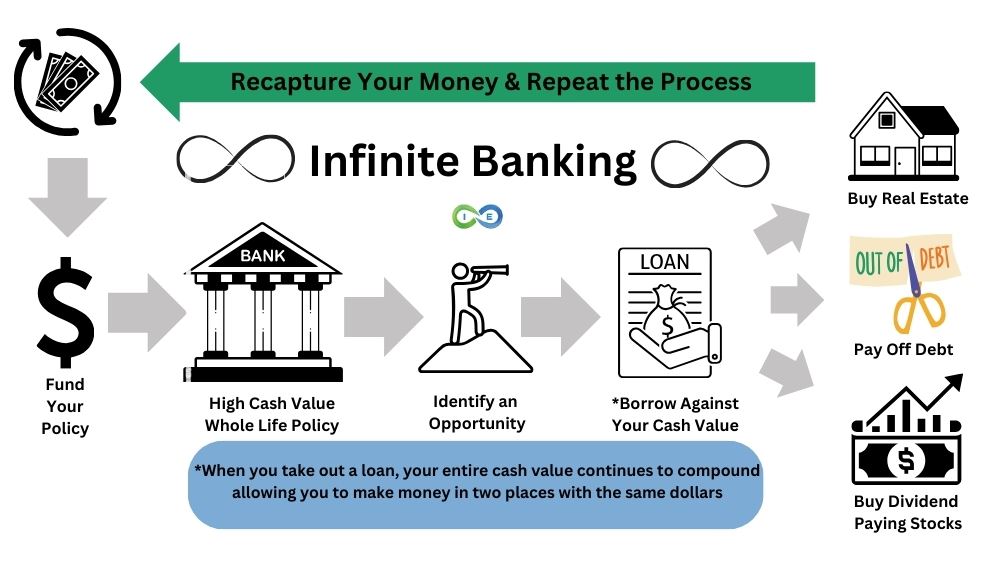

You, the insurance policy holder, placed money right into a whole life insurance policy policy through paying premiums and acquiring paid-up enhancements. This boosts the money worth of the policy, which means there is even more money for the returns price to be used to, which normally indicates a higher rate of return overall. Dividend rates at significant companies are currently around 5% to 6% - life insurance be your own bank.

The entire idea of "banking on yourself" only works since you can "bank" on yourself by taking financings from the policy (the arrow in the graph over going from whole life insurance policy back to the insurance holder). There are two different kinds of loans the insurance coverage business may use, either direct acknowledgment or non-direct recognition.

Latest Posts

Ibc Nelson Nash

Becoming Your Own Bank

Bank On Yourself Review